Is Refined Oil Trading Profitable in 2025? A Detailed Guide

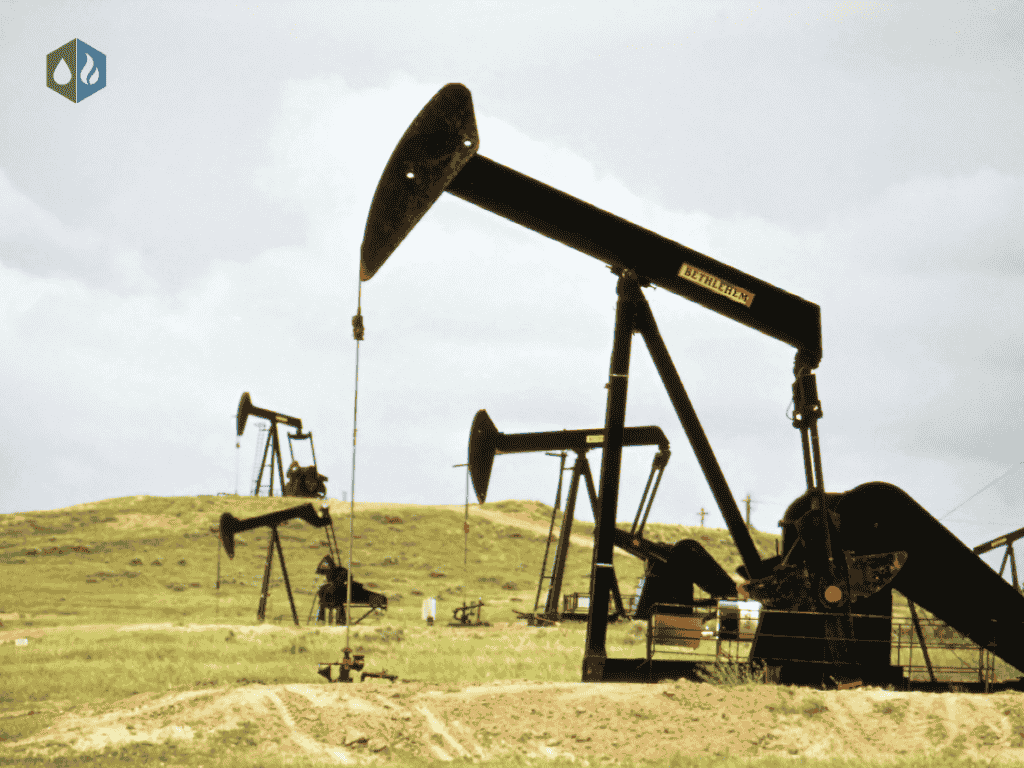

Alright, let’s cut through the noise. Everyone’s buzzing about green energy and how oil’s days are numbered. But is refined oil trading actually dead in the water? Not even close. In 2025, there’s still serious money to be made—if you know how to play your cards.

Look, the world isn’t ditching gasoline, diesel, or jet fuel overnight. Planes aren’t exactly running on good vibes and solar panels just yet. Trucks, ships, and factories? Still chugging along on refined oil products. Dubai’s own Samudra Petrochem is proof—these guys are still thriving, as long as they keep up with market curveballs, new regulations, and global demand.

What Is Refined Oil Trading?

-

Definition: After crude oil is refined, it becomes usable products like gasoline, diesel, jet fuel, heavy fuel oil, and lubricants. These are the products traded across global markets.

-

Why It Matters: Refined products are closer to daily consumer needs, making the trading faster-paced and more dynamic compared to raw crude oil.

-

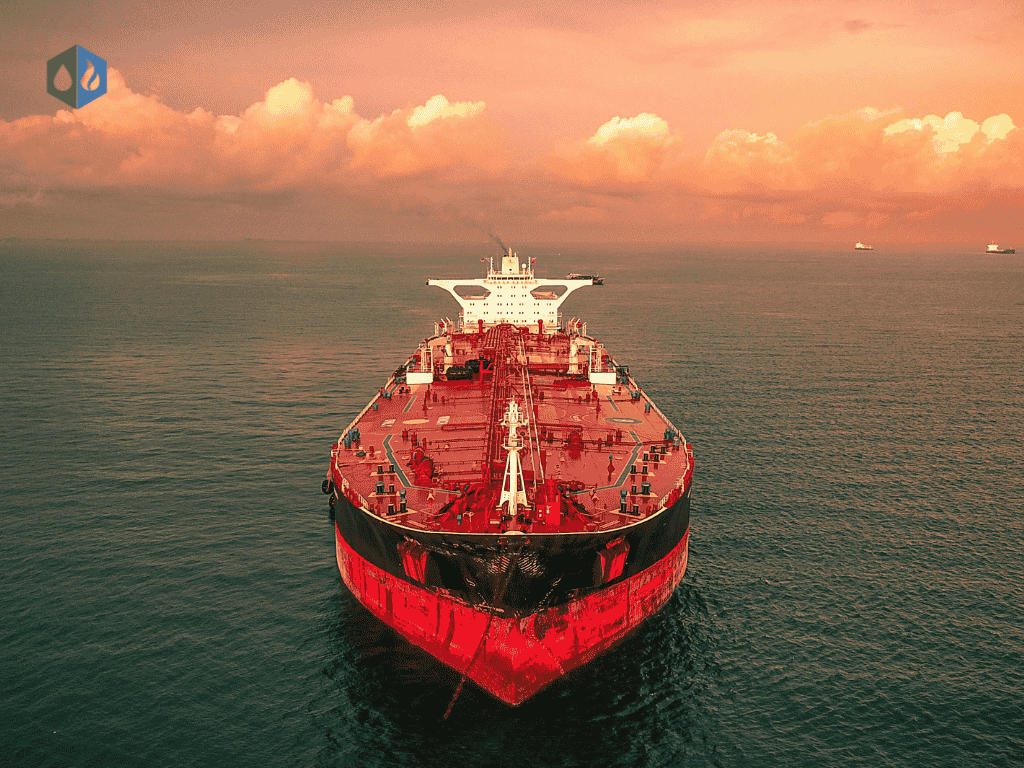

Global Hubs: Cities like Dubai serve as critical fuel trade hubs, moving refined products efficiently to regions where demand is strongest.

2025 Market Trends

-

Steady Demand: Asia and Africa’s growth ensures strong demand for refined fuels. Industrial expansion, urbanization, and increased travel keep fuel consumption high.

-

Dubai Advantage: Dubai remains a top choice for oil traders. Strong infrastructure, favorable tax policies, and global connectivity make it essential for companies like Samudra Petrochem.

-

Price Volatility: Events like OPEC decisions, geopolitical tensions, or shipping disruptions can create rapid price fluctuations—both risks and opportunities for traders.

-

Green Energy Shift: While renewables are growing, heavy industries, aviation, and shipping still rely heavily on refined oil. The transition will take decades, not years.

Keys to Profitability in 2025

-

Efficient Logistics: Every cost saved in shipping, storage, or delivery boosts profits. Samudra Petrochem focuses on a streamlined supply chain to stay competitive.

-

Regulatory Compliance: Stricter global rules mean compliance is non-negotiable. Staying ahead builds trust and avoids penalties.

-

Diversified Markets: Relying on one fuel or region is risky. Expanding across products and geographies spreads opportunity and lowers exposure.

-

Smart Risk Management: Oil markets are unpredictable. Traders using hedging strategies and market analytics reduce financial shocks.

Where’s the Money in 2025?

-

Emerging Markets: Regions like Africa and South Asia are seeing surging demand as their economies expand rapidly.

-

Technology Adoption: AI forecasting, blockchain for transparency, and digital platforms help smart traders gain an edge.

-

Eco-Friendly Fuels: Cleaner fuels, including low-sulfur products, are in high demand. Traders who supply them gain competitive advantage.

Challenges to Watch Out For

-

Environmental Regulations: Governments are imposing strict emissions rules. Traders must adapt to remain relevant in a decarbonizing world.

-

Intense Competition: Global hubs like Dubai, Singapore, and Rotterdam attract aggressive players. Only companies with strong strategies, like Samudra Petrochem, thrive.

Conclusion

So, is refined oil trading still profitable in 2025? Absolutely—if approached strategically. With demand from emerging markets, strong logistics, compliance, and risk management, the sector remains highly lucrative. Companies like Samudra Petrochem show that success comes to those who innovate, diversify, and stay resilient in an evolving energy landscape.